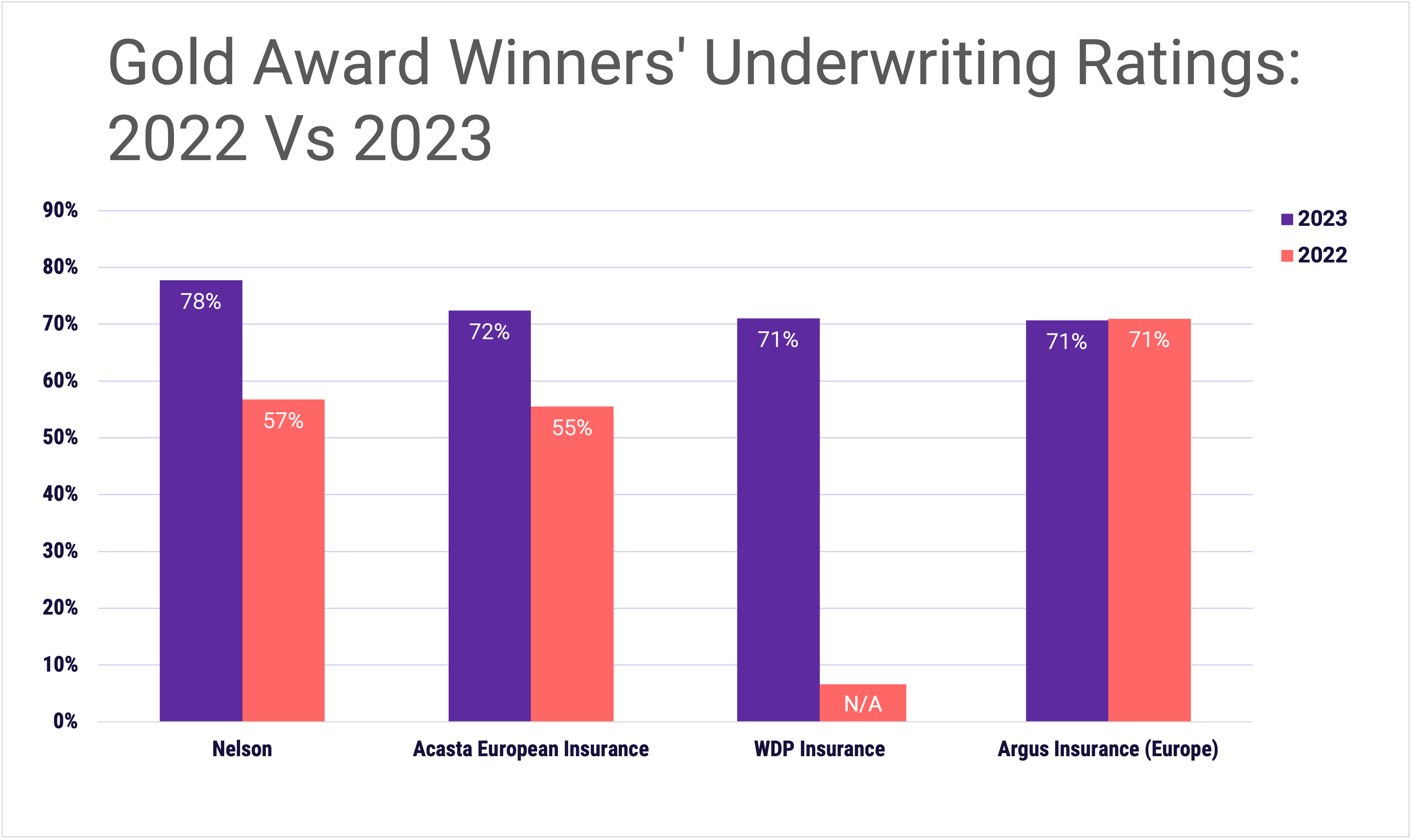

Our latest Gibraltar Underwriting Ratings has named Nelson as the best insurer in Gibraltar with a score of 78% for 2023, up from 57% a year earlier.

The insurer’s market-leading performance was driven by a massively improving combined operating ratio (COR) that dropped 34.9 percentage points to 77.3% as Nelson made a return to underwriting profitability.

Nelson is joined on this year’s list of Gold Award winners by Acasta European Insurance with a score of 72%, WDP Insurance (71%) and Argus Insurance Europe (71%).

Based on our own proprietary formula, the research rated every Gibraltar-regulated insurer across three key metrics to assess their underwriting performance – COR, aggregate COR over the last three years, and the improvement in the COR for the most recent year.

And the research found that Gibraltarian insurers have fallen behind their UK counterparts for the first time with an aggregate rating of 51% for 2023, some 13 percentage points behind the UK aggregate.

This also marks a 14 percentage point deterioration on the previous year when Gibraltarian insurers received an aggregate score of 65% – marginally ahead of their UK-regulated peers.

A significantly higher COR was the driving force behind this decline in performance, with the Gibraltarian market reporting a loss-making COR of 102.6%, some 20.6 percentage points higher than the previous year.

This led to an aggregate COR Improvement Rating of just 15% for 2023 (2022: 57%) and a COR Rating of 65% (2022: 73%).

Much of this drop-off in performance can be attributed to ongoing claims inflation, which has been particularly hard felt in Gibraltar due to the dominance of personal lines motor business.

Rising premiums will, of course, help to ease some of these pressures, but with Gibraltarian insurers reinsuring more than two-thirds of their risks, reinsurance rates will be pivotal to short-term performance.

The Bank of England is forecasting that inflation will continue to drop over the coming year, but the next renewal date could come too soon for that to have a beneficial impact on rates.

Underwriting Ratings for every insurer are available through the Insurance DataLab market intelligence platform, with scores broken down by business line to reveal which insurers are delivering a best-in-class performance in the markets that matter to you.

Register for a free trial of the platform here, and find out how Insurance DataLab can help your business better understand the market.