The Lloyd’s market reported an underwriting profit of more than £1.5bn for 2022, a 29% increase on the previous year as its profitable resurgence continues following a period of unprofitability in the wake of the Covid-19 pandemic.

This increase in underwriting profits comes despite a 41% increase in gross claims incurred, which was largely driven by a jump in marine, aviation and transport (MAT) claims.

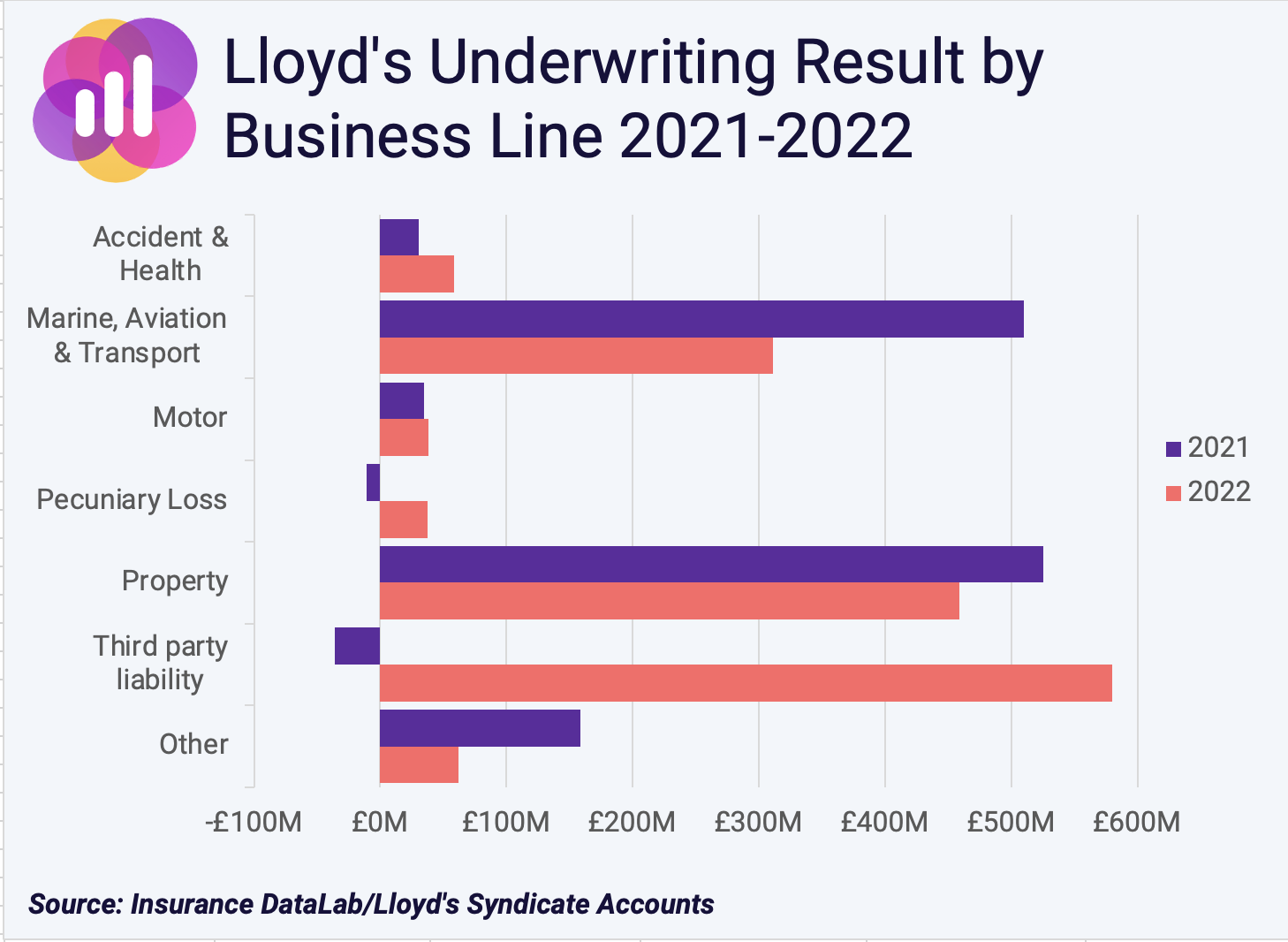

Claims for this business line rose by more than 79% as it broke through the £3bn barrier and underwriting profits fell by almost two-fifths to £311.4m.

This compares to an underwriting profit of £590.8m in 2021 when it was the second most profitable business line behind property insurance with an underwriting profit of £525.2m.

Meanwhile, gross written premium (GWP) across all business lines rose by more than a quarter, increasing to £31.3bn – up from a little under £25bn the previous year.

This increase in performance comes despite a 29% increase in gross claims to £7.5bn, which was offset by a corresponding increase in premiums.

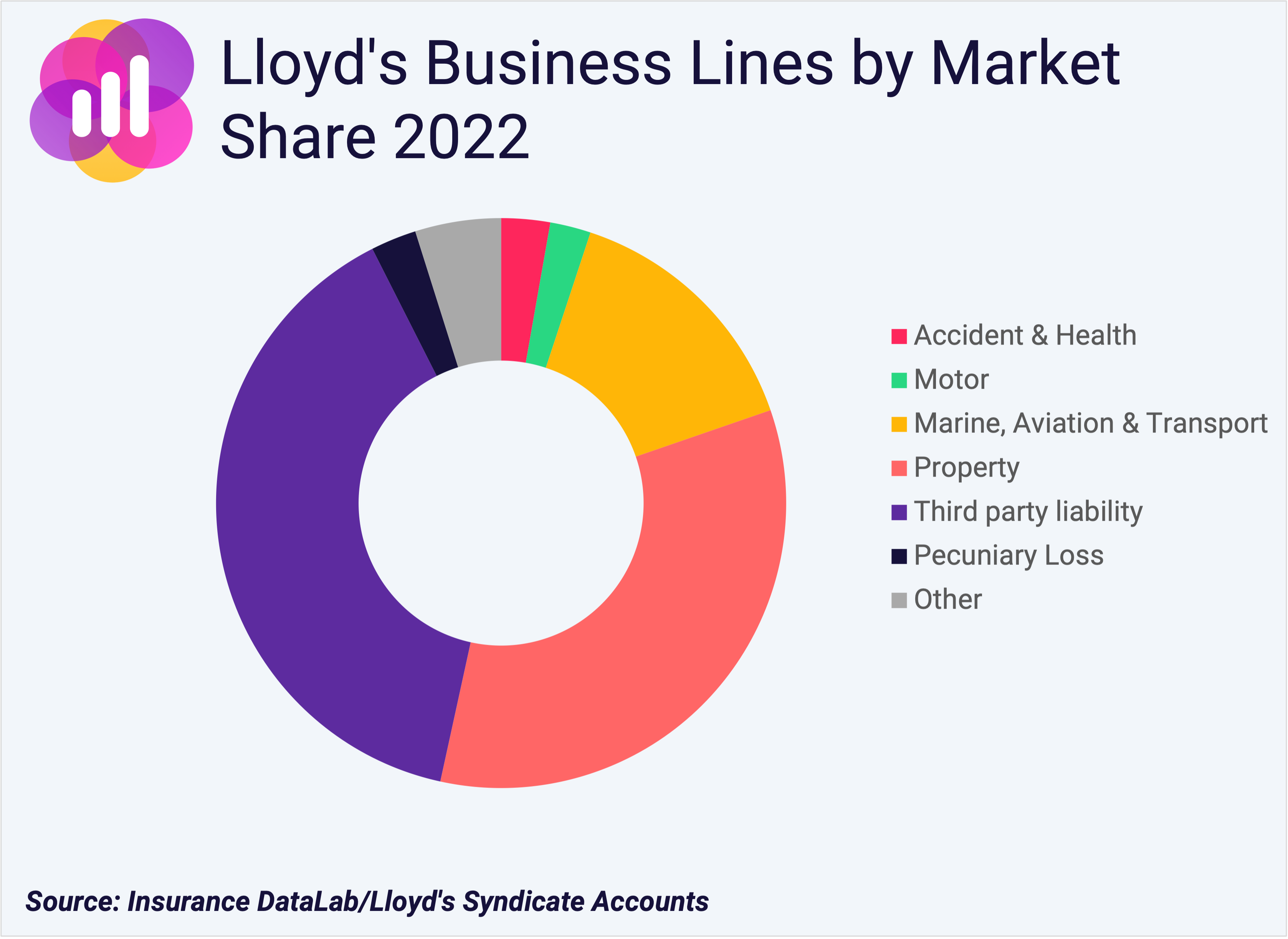

Third party liability continues to be the largest business line, accounting for 39% of the total market with GWP totalling £12.3bn for 2022. Property insurance is close behind with GWP of £10.6bn, equal to 34% of total market premiums.

As well as being the largest line of business at Lloyd’s, third party liability insurance was also the most profitable after it reported an underwriting profit of £580.2m. This compares to an underwriting loss of £36.3m in 2021.

Performance was boosted by an improving reinsurance position, which saw fewer net premiums ceded to reinsurers, and a reduction in expenses relative to the overall premium base.

Pecuniary loss was the other business line to return to underwriting profit after an unprofitable 2021, reporting an underwriting result of £37.5m for 2022. This is up from a loss of £10.9m the previous year.

This means that every business line at Lloyd’s reported a profitable 2023, with only three business lines – property, MAT and other – reporting a worsening underwriting position over 2022.