The future of broking is always a hot topic in the insurance world, with increased regulation, evolving market dynamics, emerging technology, and even new start-ups all changing the way brokers go about conducting business.

In a world of so much change, it can often be hard to know just where to look and where to focus your efforts to make the most of the opportunities available to you and your business.

That is why we are hosting a webinar at 11am on Wednesday 18 May to discuss all of these challenges and opportunities, as well as what lays ahead in the exciting world of broking M&A.

The session will be moderated by Insurance DataLab co-founder Dan King, and will feature a number of leading industry experts who will discuss the burning issues affecting the industry, as well as taking questions from the audience.

The webinar will also explore the results of our upcoming Broker Performance Report, which will rate and rank the 100 largest brokers in UKGI on their profitability, productivity and growth over the last three years.

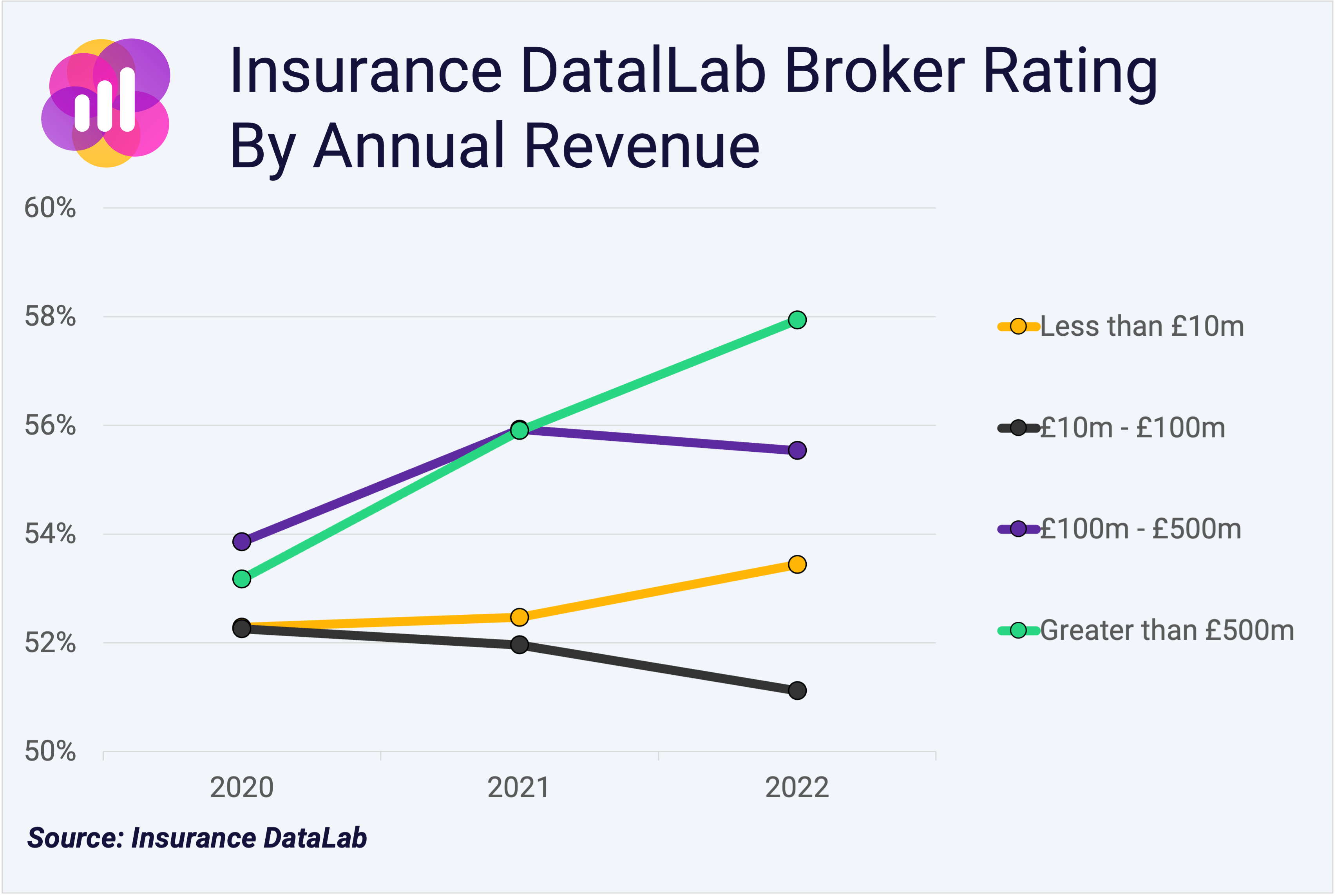

Preliminary findings from this research have found that the financial performance of these brokers over the last three years has remained relatively steady, with the average Insurance DataLab Broking Rating standing at 52.9% for 2022, compared to 52.8% for 2021 and 52.4% for 2020.

Interestingly, however, larger brokers have fared better than their smaller counterparts.

The largest brokers in this analysis – those with revenues greater than £500m – received an average Broking Rating of 57.9% for 2022, compared to 55.5% for brokers with revenues between £100m and £500m, 51.1% for firms with revenues between £10m and £100m, and 53.4% for smaller brokers with annual revenues under £10m.

This outperformance by the largest brokers has been driven by standout performances on our Growth Rating metric – brokers with revenues greater than £500m outscored their smaller peers by at least seven percentage points with a Growth Rating of 59.1% for 2022.

This has not always been the case, however, with the £500m+ brokers only taking the top spot last year after finishing second in both 2020 and 2021.

Additional insight and analysis into these results, as well as ratings for the 100 largest brokers in UKGI, will be available in our upcoming Broker Performance Report. Everyone who registers for the webinar will be sent a free abridged version of the report. Claim your free place here.