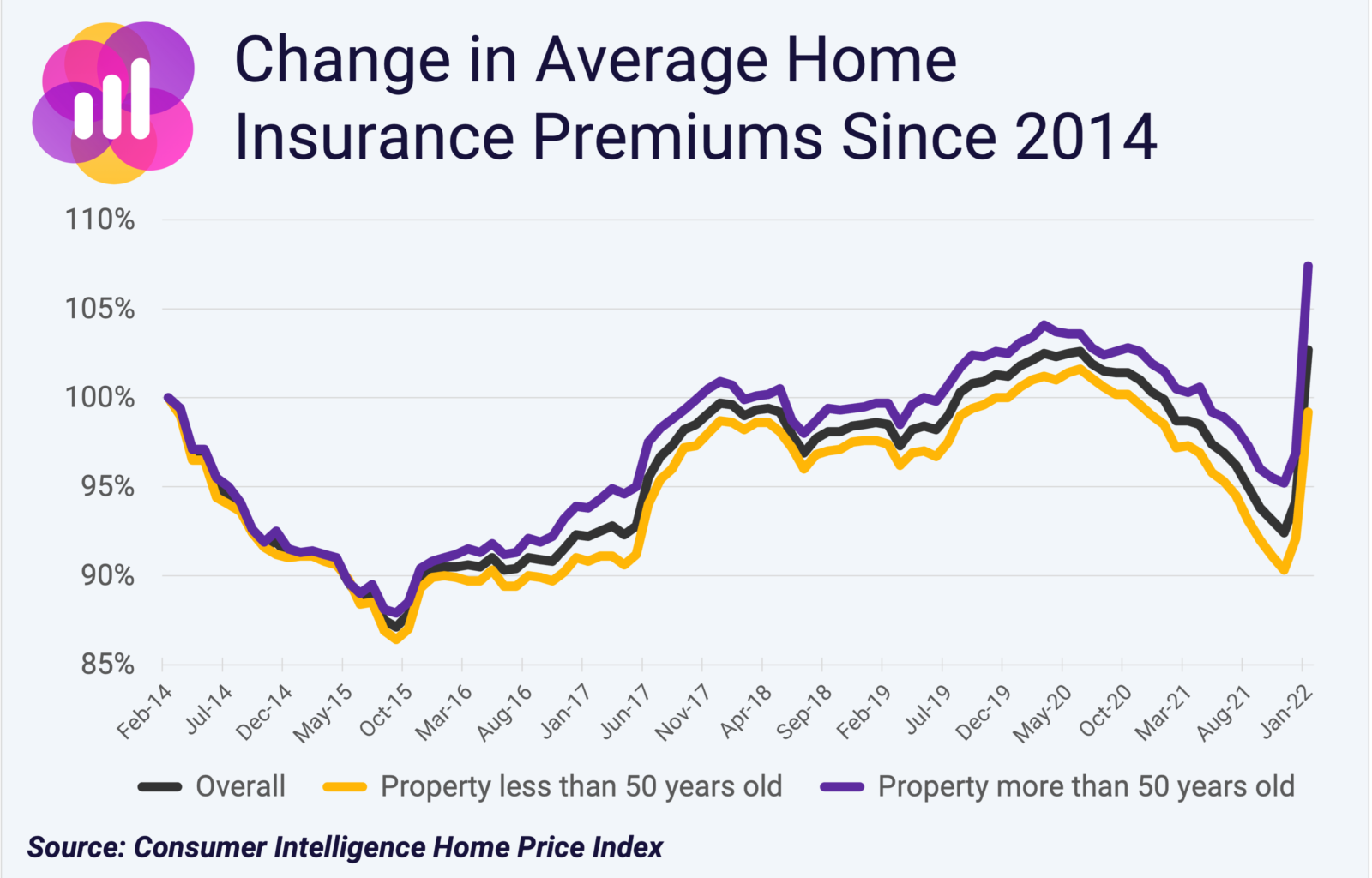

Home insurance prices surged over the course of January, so much so that, according to the latest Consumer Intelligence Home Insurance Price Index, average premiums are currently at their highest levels since the company started recording this data all the way back in February 2014.

All of this has been driven by the General Insurance Pricing Practices (GIPP) that came into force at the beginning of the year, meaning that insurers are now not allowed to offer different prices to new and existing customers.

This means that many insurers will have been forced to cut their renewal prices, while new business rates have soared to meet in the middle.

Interestingly, further research from Consumer Intelligence has suggested that, somewhat counterintuitively, drastic reductions in renewal rates could make customers more likely to shop around at renewal.

This is a particular problem for insurers that have practiced price-walking in the past, and now find themselves sitting on a large backbook of business that could soon be shopping around for the first time in quite a few years.

Ultimately, this means that competition for new business is only going to intensify as we continue through 2022, and some of the smaller players (without the hindrance of those large backbooks) could look to take advantage by offering more competitive premiums in an effort to increase their share of market.

For many, this means that customer loyalty is going to be vital in the coming months in order to secure ongoing premiums without costly acquisition costs, and offering a best-in-class customer experience is key to success in this area.

In this new Age of Fair Value, customer experience has arguably never been more important in terms of loyalty, but when it comes to the hard and fast reality of underwriting performance, just how important is customer experience?

Here at Insurance DataLab we are all about answering these types of questions, so we have run the numbers and the answers are quite clear.

We looked at the performance of the UK’s leading insurers in our inaugural Customer Experience Report and compared this with how they fared in our Underwriting Performance Ratings.

By plotting each insurer’s CX Rating with their Underwriting Rating, we were able to calculate a Pearson correlation coefficient of around 0.42, which represents a moderate level of positive correlation between customer experience and underwriting performance.

Without wanting to get too deep into the murky world of statistics, this correlation was significant at the 10% level with a p-value of 0.055 – this means that for every increase in the CX Rating, you can expect to see a corresponding increase in an insurer’s Underwriting Rating.

A little bit more maths by way of some linear regression also reveals that every percentage point increase in the CX Rating leads to just over a 0.3 percentage point increase in the Underwriting Rating.

Now, this might seem like a small increase and, while insurers should of course be looking to offer a good customer experience for reasons beyond just the pure financial benefits, you may be asking just how significant this actually is.

Well, our analysis also shows that of the five lowest-ranked insurers in our CX Ratings, four were also in the bottom five for underwriting performance.

And indeed, of the five insurers ranked top for customer experience, three reported a sub 100% combined operating ratio (COR). This compares to just 28% of insurers across the whole sample achieving an underwriting profit with a COR of less than 100%.

Of course, this analysis cannot definitively say that offering a better customer experience will equate to better underwriting results, but the numbers do seem to back that argument up.

There is, of course, always the exception to the rule – Admiral seems to be a case in point here after reporting a market-leading 78% Underwriting Rating, while only achieving the seventh best CX Rating (65%).

But when you look at everything in the context of the FCA’s pricing reforms and how that has intensified the battle for new business, it is clear to see that customer experience is certainly going to be one of the driving forces behind success in 2022.

With the customer becoming increasingly important, it is now more vital than ever to keep on top of how you are performing – as well as how you stack up against your peers when it comes to customer experience.

Insurance DataLab has a wealth of information on exactly this, covering everything from Financial Ombudsman Service complaints figures to Fairer Finance Customer Experience scores.

Soon, we will also be adding our very own Insurance DataLab CX Ratings to the hub, taken from our inaugural Customer Experience Report.