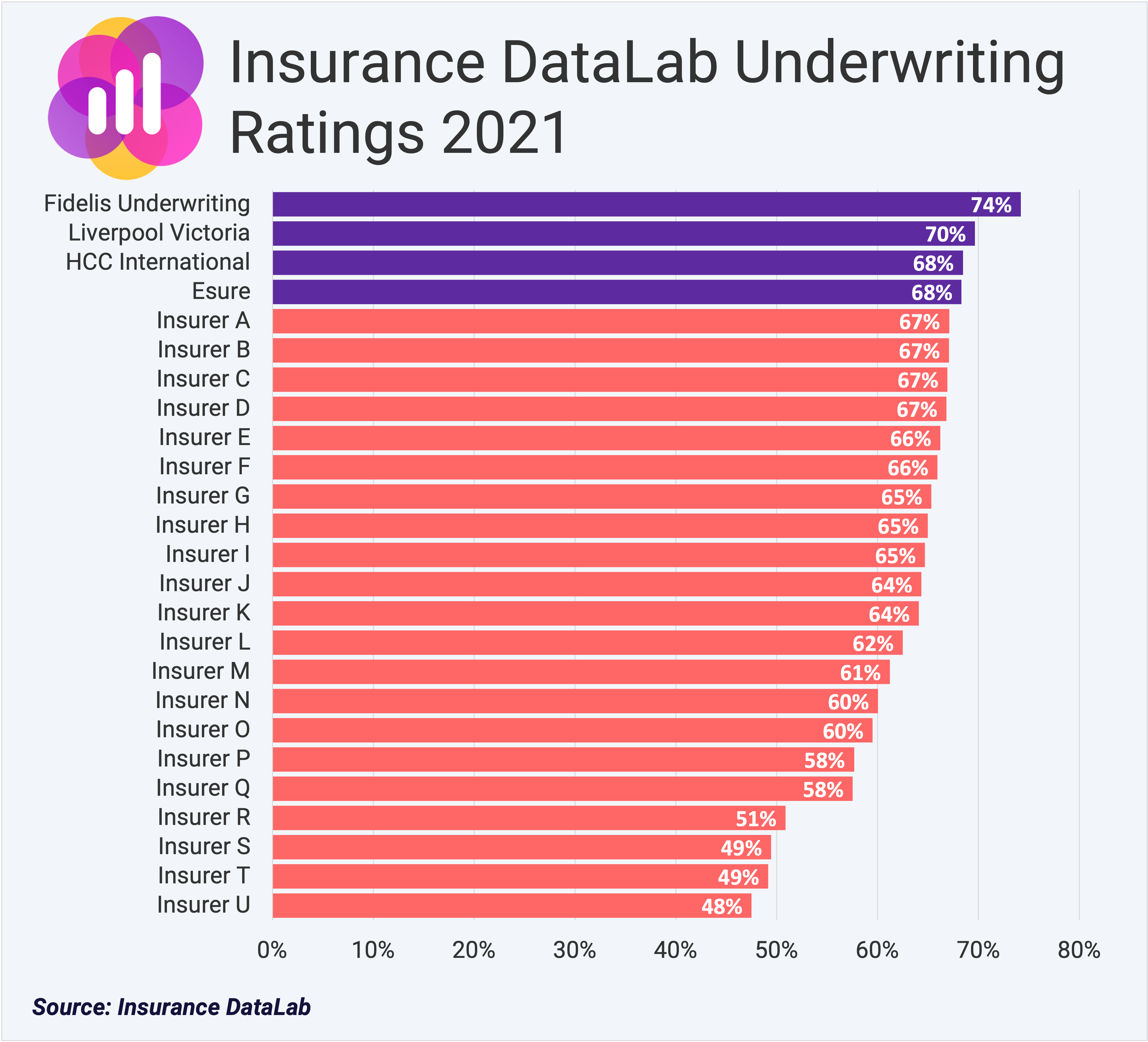

Our inaugural UK Underwriting Performance Report has named Fidelis Underwriting as the best insurer in UKGI with an Underwriting Rating of 74% for 2021.

Liverpool Victoria, HCC International and Esure have also been recognised as top performers, with all four insurers winning Insurance DataLab Gold Awards.

Based on our own proprietary formula, devised specifically for this report (you can download a free summary version here), the research rated the 25 largest UK-regulated insurers across three key metrics to assess their underwriting performance – combined operating ratio (COR), aggregate COR over the last three years, and the improvement in the COR for the most recent year.

The research found that overall underwriting performance has improved marginally over the last 12 months to 64%, up from 63% for 2020 and 62% for 2019.

But the varying impacts of the Covid-19 pandemic have led to differing fates for commercial and personal lines insurers.

In commercial lines, for example, the furore around the business interruption scandal has been an ever present in the headlines of not only the trade press, but the nationals too, as insurers were taken all the way to the High Court.

In the end, as we all know, the court found that insurers were liable for a large portion of the business interruption claims that they had been contesting, leaving insurers facing hundreds of millions of pounds worth of claims.

The impact of these claims, as well as the challenging economic environment, means that it is therefore no surprise that commercial lines insurers received the lowest rating across our research.

Indeed, commercial lines insurers picked up an Underwriting Rating of just 61% for 2021.

This compares to a score of 69% for personal lines insurers, and 63% for those insurers that write a mixture of both personal and commercial lines.

The impact of Covid-19-related business interruption claims has hit the property insurance market hard, meaning that the business line has received the lowest Underwriting Rating of 2021 with a score of 57% – this is down from 63% a year earlier.

At the other end of the scale, medical expenses insurance has performed strongest, with insurers operating in this space benefitting from a drop-off in claims in the wake of the Covid-19 pandemic as private hospitals suspended treatments to help the NHS cope with the surge of coronavirus patients that swept the country at the height of the pandemic.

Many patients also chose to delay elective procedures as a result of the increased risk from Covid-19, with the impact of all these changes meaning that net incurred claims in the medical expenses sector fell by almost 13% to £3.1bn in the latest set of insurer Solvency and Financial Condition Reports (SFCRs), down from £3.6bn a year earlier.

Motor insurance, meanwhile, has experienced the greatest positive impact stemming from the Covid-19 pandemic, with an average underwriting rating of 64% for 2021 placing it in second place on the list of best performing product lines.

This compares to a rating of just 58% for 2020, when motor insurance was the worst performing product line in UKGI.

Like insurers operating in the medical expenses insurance space, motor insurers also benefitted from a drop-off in claims in the wake of the Covid-19 pandemic, largely as a result of the stay-at-home orders introduced by the UK government due to the lockdown measures brought in to reduce the spread of coronavirus.

Changing regulations are also having an impact.

The FCA’s new General Insurance Pricing Practices (GIPP) are changing the way the market operates, and not just in personal lines, but for the commercial sector too.

This means that understanding the latest developments – and how that will affect the underwriting performance of you and your competitors – is key, and this report aims to provide you with exactly that information.

Not only does the report provide a summary of how the market has performed overall, but there is also a detailed breakdown of the strengths and weaknesses of each of the 25 insurers in the rankings, broken down by their individual business lines.

Want to find out more about how your competitors are performing when it comes to underwriting performance? Our full UK Underwriting Performance Report is only available to subscribers, but you can download a free summary version of the report. This abridged version includes an analysis of market performance across business lines, as well as the headline Underwriting Rating for each of the 25 insurers in this analysis.

We have also calculated scores for every UK and Gibraltar regulated non-life insurer. These scores, broken down by business line for each insurer, will soon be available to view and download on our digital insight platform. Email us if you’d like to get access at info@insurancedatalab.com or call us on 020 3488 8200.