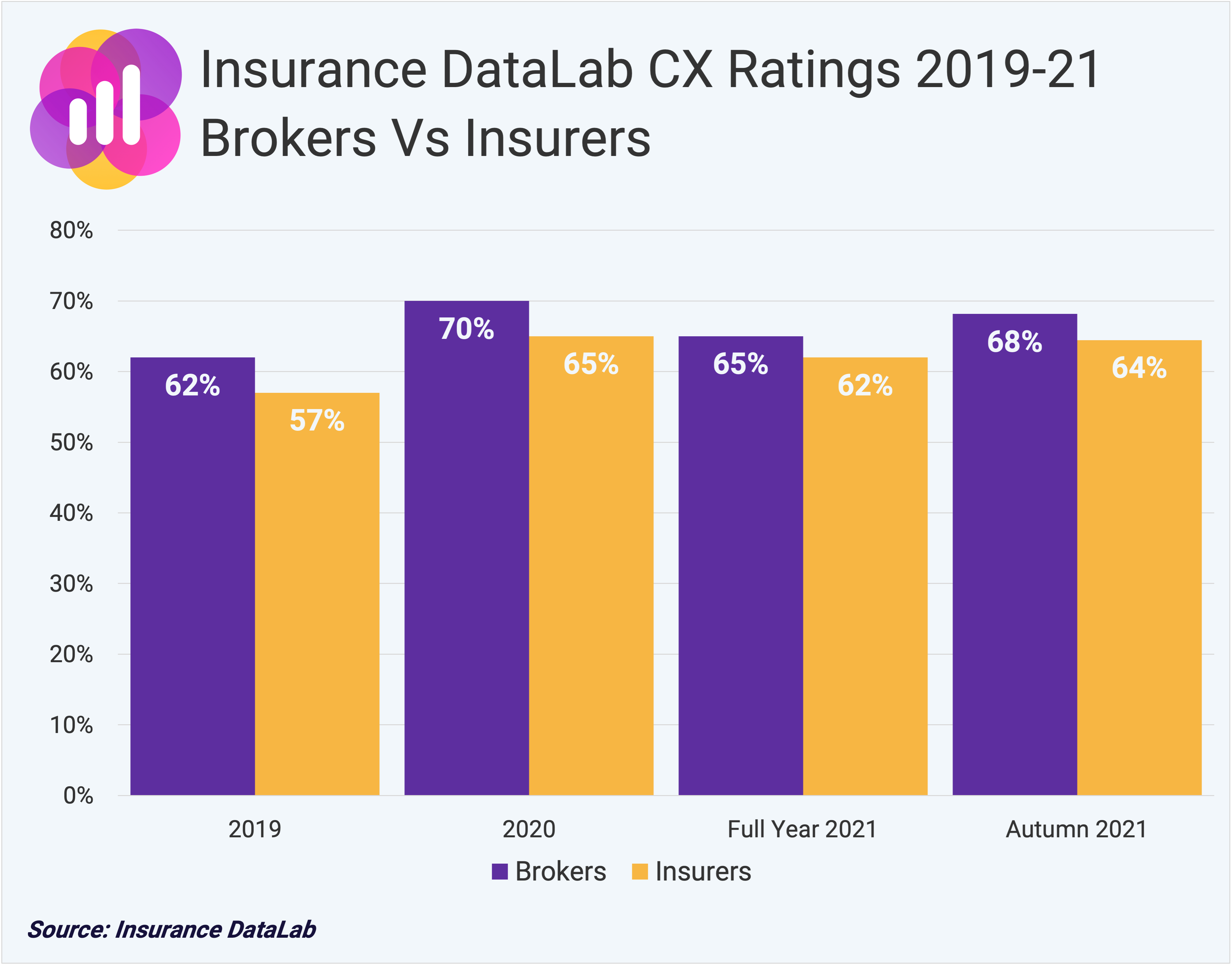

The research also found that brokers continue to outscore insurers when it comes to customer experience, picking up an average score of 68% for Autumn 2021.

This latest score represents a three percentage point increase on the 65% rating brokers received in the full ratings published in Spring 2021.

Insurers, meanwhile, picked up an average Autumn 2021 score of 64%. This represents a two percentage point improvement on the 62% average rating insurers received in the full-year rankings, which means that brokers have extended their lead over their insurer counterparts to four percentage points.

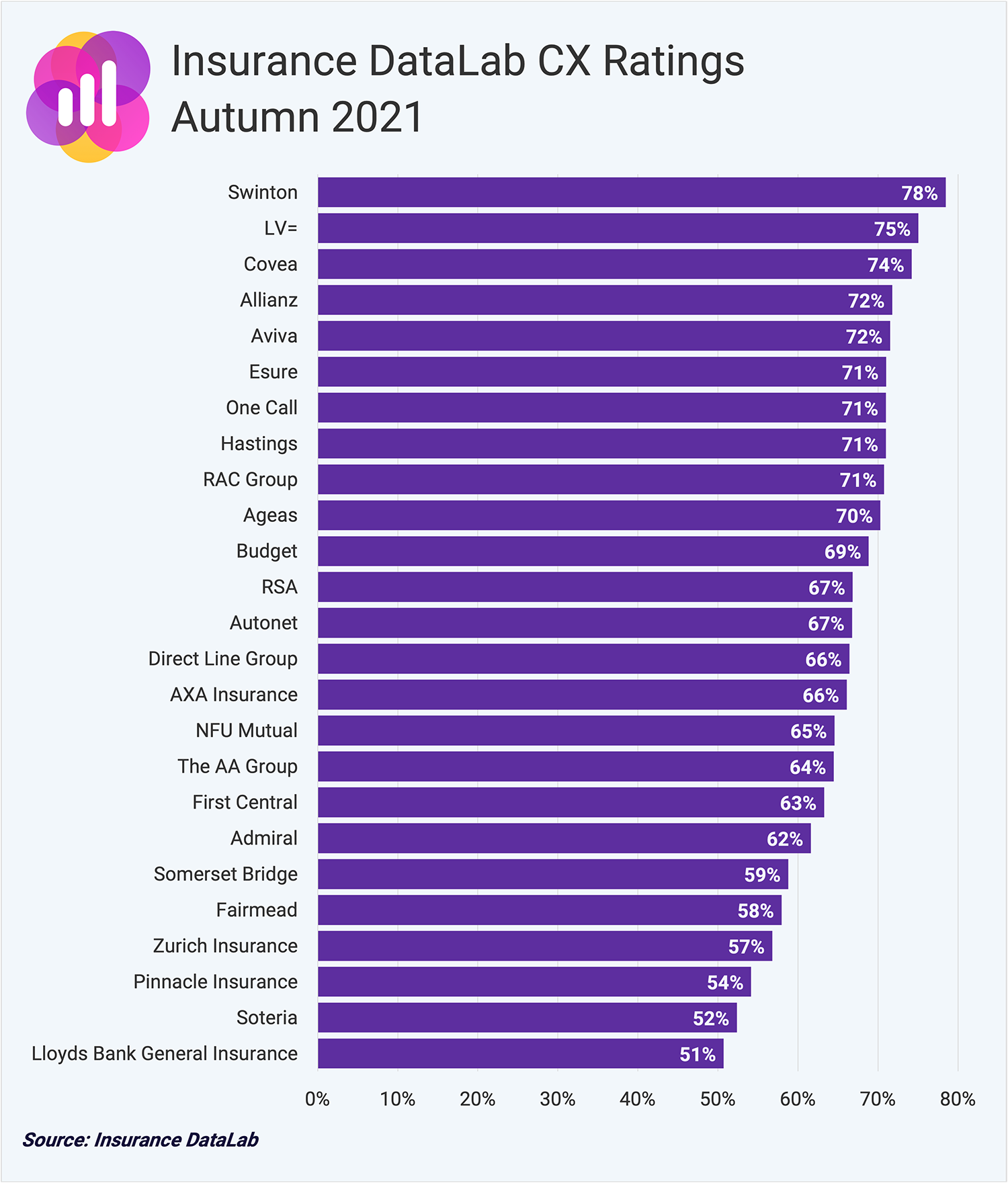

Indeed, broker Swinton has climbed to the top of our rankings, replacing LV= at the summit after the insurer fell to second despite a one percentage point increase to its overall CX rating.

Swinton received an overall Insurance DataLab CX Rating of 78% for Autumn 2021, some 14 percentage points better than the 64% rating received in the full 2021 rankings.

This improvement in the broker’s performance was fuelled by a much-improved complaints handling score off the back of a significantly lower upheld rate. The broker’s full-year 2021 score was also adversely affected by a large percentage increase in the number of cases being referred to the ombudsman, despite experiencing low overall volumes.

Of the bottom five rated companies, all are insurers, with Lloyd’s Bank General Insurance falling to the foot of the rankings despite a one percentage point increase in its CX rating to 51%.

Meanwhile Pinnacle Insurance, which was bottom of our rankings in the full 2021 results, improved its overall score by eight percentage points to jump two places to 23rd with an overall rating of 54%.

Across all of the metrics used in this analysis, brokers received their highest rating from TrustPilot, picking up an average score of 87%. This is 14 percentage points higher than the 73% rating achieved by insurers, despite the broker rating falling by one percentage point over the course of the last six months.

The broking market also performed stronger than insurers on complaints handling, with the average broker rating coming in at 63% for Autumn 2021, compared to 60% for insurers.

This marks a turnaround in fortunes for brokers after insurers outscored brokers by eight percentage points in the full 2021 edition of our rankings with an Insurance DataLab Complaints Handling Rating of 59%.

While insurers saw their average complaints handling rating climb by one percentage point over the last six months, brokers improved their rating by an impressive 12 percentage points.

This improvement was fuelled by a 17% decrease in the volume of complaints about brokers referred to the Financial Ombudsman Service (FOS) over the second quarter of 2021, compared to a 6% decrease in complaints for the insurers included in this analysis.

When it comes to how Fairer Finance rates the companies in this analysis, however, it was insurers who came out on top.

The average Fairer Finance rating for brokers stood at 54% for Autumn 2021, compared to 58% for insurers.

This represents a two percentage point improvement for insurers, up from 56% in the full report. Brokers, meanwhile, saw their Fairer Finance rating fall by one percentage point over the same period.

The companies in this analysis were rated highest for the transparency of their pre-purchase journey, with brokers and insurers both receiving a 61% rating under this metric.

This means that insurers increased their transparency rating by three percentage points over the last six months, while brokers remained steady at 61%.

The biggest difference in the scores between brokers and insurers, however, came under the Fairer Finance trust metric, with insurers outscoring brokers by an average of seven percentage points.

Under this trust metric, insurers received an average rating of 54%, up from 46% six months earlier. Brokers, meanwhile, saw their average rating fall to 47%, down from 49% in the full report.

Note: Updated on 2 December 2021 to allow for a revision of the rankings. This was to incorporate a more robust method of calculating the complaints handling rating for companies that did not have at least 10 cases resolved by the Financial Ombudsman Service in Q2 2021.

Performance metrics have been calculated using our own analysis of FOS complaints figures, which takes into account both complaints volumes and the provider’s upheld rate, as well as data provided by our partners.

The figures in this analysis are a half-year update of the full figures published in our annual Underwriting Report, the inaugural edition of which was published in Spring 2021.

You can download a free abridged version of this report here, with the next edition of this report due to be released in Spring 2022.