The ombudsman received a little under 9,000 complaints over the three months to the end of June, up from 8,586 for the same period a year earlier.

This means that complaints volumes are more than a third higher than before the start of the Covid-19 pandemic, with the FOS receiving just 6,533 complaints over the course of Q1 2020.

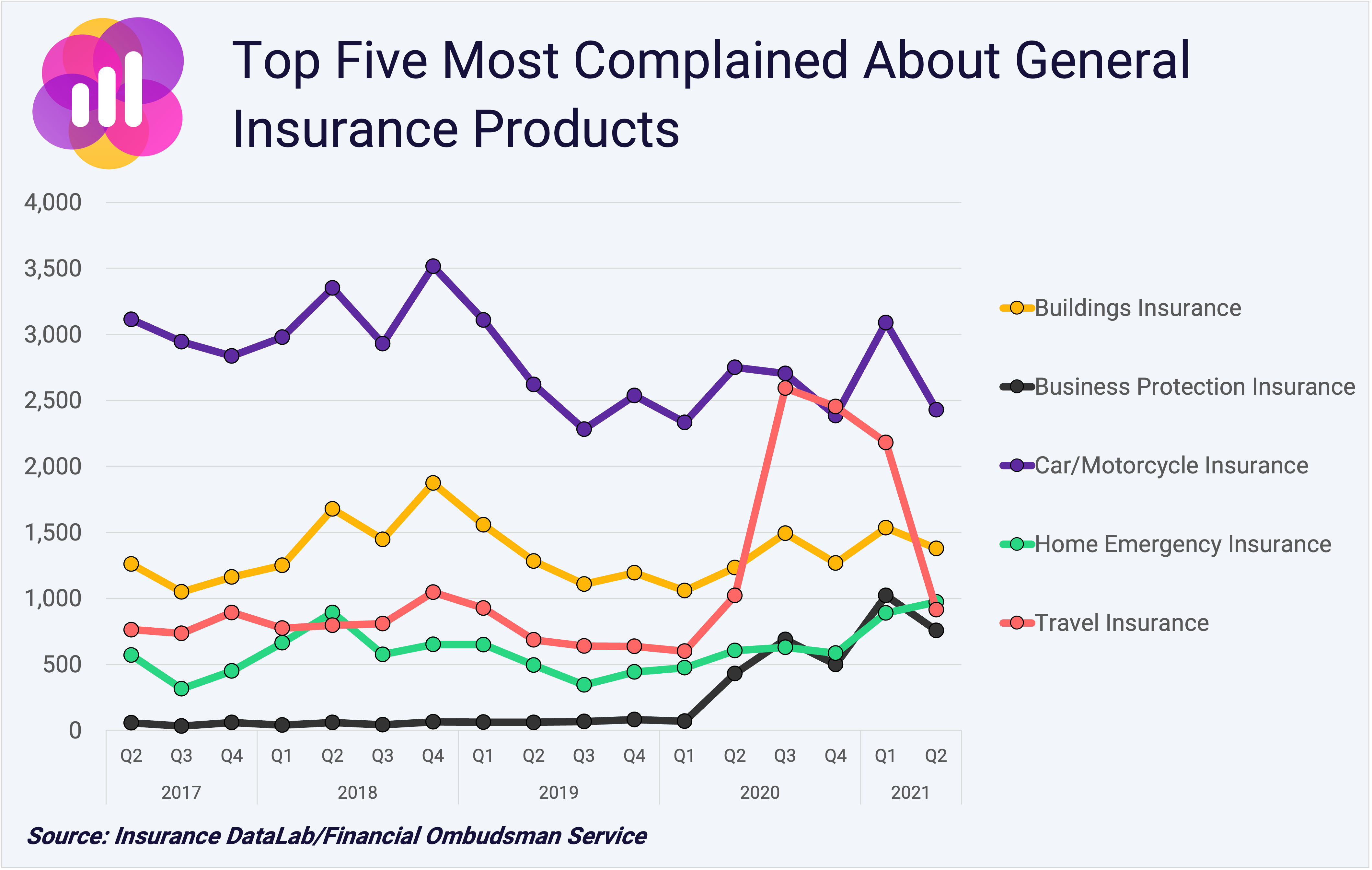

Car and motorcycle insurance remains the most complained about product line, with the 2,429 complaints referred to the FOS in Q2 2021 accounting for more than a quarter of all insurance complaints.

This is despite the total number of motor complaints dropping by 12% compared to the same period a year earlier, with motor insurer’s still benefiting from the reduction in driving miles in the wake of the Covid-19 pandemic, and the subsequent increase in homeworking.

Across all Q2 2021 motor complaints, around 61% relate to the claims process, with a little over a third related to administration, and less than 2% related to sales and advice.

This compares to around 79% of complaints relating to the claims process across all product lines, with just under 21% relating to admin issues, and less than 0.5% relating to sales and advice.

One of the biggest impacts of the pandemic was felt in the travel sector. Travel insurance overtook motor insurance as the most complained about product in Q4 2020, with the FOS receiving more than 2,400 complaints – almost four times the level seen for the same period in 2019.

Travel-related complaints have subsided since, however, and are now dropping back towards pre-Covid levels.

Sticking with the pandemic theme, and business protection insurance has seen a surge in complaints referred to the FOS over the course of the last 12 months.

The number of cases reaching the ombudsman has increased year-on-year for each quarter as far back as June 2018 (when we first started tracking these increases), peaking at 1,022 complaints for Q1 2021.

Indeed, the volume of complaints referred to the ombudsman over the last year has grown more than fourfold to almost 3,000 for the 12 months to the end of June 2021, up from just 646 a year earlier.

This means that business protection insurance now accounts for 8% of all GI complaints referred to the FOS, up from just 0.8% three years ago.

Despite this increase, only 15% of business protection complaints were upheld in favour of the customer over the course of Q2 2021, compared to an average across all lines of 32%.

These figures do need to be taken in context, however, with 55% of business protection complaints upheld in favour of the customer in Q1 2021, and 7% in Q4 2020 – highlighting the complicated nature of this particular product line.

Of course, the furore surrounding business interruption claims has been well-documented in the insurance trade press, with the case making it all the way to the High Court last year.

Many more insurers have now started paying out on these claims, but this continued rise in complaints relating to business protection insurance highlights that the industry is still grappling with the issue and customers are still feeling hard done by.

Want to find out more about the FOS complaints data available on Insurance DataLab, including how you can compare the performance of insurers and brokers across the whole of UKGI? Then get in touch now for your free demo.